Sustainability Policy

Emerge Capital Management (“EMERGE”) was launched in 2016 to make actively managed investment strategies accessible to investors. We offer a comprehensive range of products, focusing on thematic and multi-sector investment strategies that have the potential to transform industries through innovation, sustainable growth, and market leadership.

Our Responsible Investment philosophy is integrated within the realm of these strategies that are available through Separate Account strategies.

Emerge’s Sustainability Belief

Investing in forward-thinking companies is a part of our core philosophy and product offering. We believe that the future of innovative products and services will be greatly influenced by global sustainability issues and the risk associated with them. Thus, investment managers that effectively assess environmental, social, and government “ESG” factors are more likely to generate sustained performance, while having a positive impact the society.

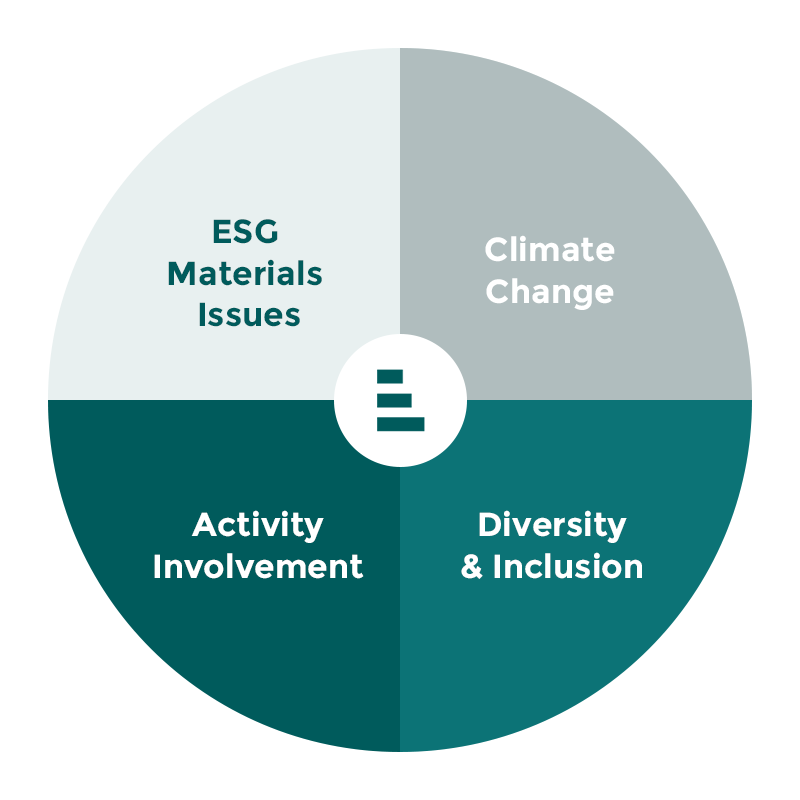

At Emerge, our focus on environment social, and corporate governance is centered around four broad base categories:

- ESG Materials Issues

- Climate Change

- Activity Involvement

- Diversity and Inclusion

What does it mean to invest in sustainable companies?

Sustainable investing directs investment capital to companies that incorporate Environ-mental, Social and Governance (ESG) factors into their business operations. These ele-ments are considered by organizations when assessing the ethical impact and sustain-ability of their firm. Each of the three components contains criteria that organizations evaluate in efforts to make their operations more sustainable and ESG-friendly.

Our Sustainability Approach and Methodology

Our approach to investing aims to integrate our investment objectives with the recommended UN princi-ples of responsible investing. Emerge integrates ESG considerations through proxy voting and engagement with companies and/or portfolio managers.

Incorporate sustainable investment analysis and decision-making process

Be active owners and incorporate sustainable ownership policies and practices

Seek appropriate disclosure on sustainability issues by the entities we invest in

Promote acceptance and implementation of principles within the investment industry

Work together to enchance our effectiveness in implementing the principles

Report on our activities and progress towards implementing the principles

![]()

Exclusion Filters

- Biological & Chemical Weapons

- Thermal Coal Extraction

- Gambling

- Tobacco Production

- Recreational Cannabis

- Alcohol Production

- Adult Entertainment

![]()

Decisional Filters

- Overall ESG Materiality Risk

Our Sustainability Consultant

Emerge has retained Milani to provide third party Sustainability Consulting on all Emerge investment products.